Page 232 - InterloopAnnualReport2020

P. 232

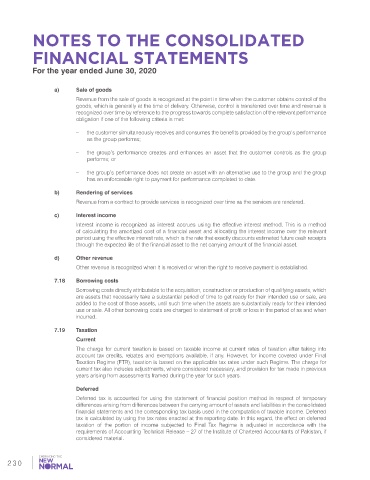

NOTES TO THE CONSOLIDATED

FINANCIAL STATEMENTS

For the year ended June 30, 2020

a) Sale of goods

Revenue from the sale of goods is recognized at the point in time when the customer obtains control of the

goods, which is generally at the time of delivery. Otherwise, control is transferred over time and revenue is

recognized over time by reference to the progress towards complete satisfaction of the relevant performance

obligation if one of the following criteria is met:

– the customer simultaneously receives and consumes the benefits provided by the group’s performance

as the group performs;

– the group’s performance creates and enhances an asset that the customer controls as the group

performs; or

– the group’s performance does not create an asset with an alternative use to the group and the group

has an enforceable right to payment for performance completed to date.

b) Rendering of services

Revenue from a contract to provide services is recognized over time as the services are rendered.

c) Interest income

Interest income is recognized as interest accrues using the effective interest method. This is a method

of calculating the amortized cost of a financial asset and allocating the interest income over the relevant

period using the effective interest rate, which is the rate that exactly discounts estimated future cash receipts

through the expected life of the financial asset to the net carrying amount of the financial asset.

d) Other revenue

Other revenue is recognized when it is received or when the right to receive payment is established.

7.18 Borrowing costs

Borrowing costs directly attributable to the acquisition, construction or production of qualifying assets, which

are assets that necessarily take a substantial period of time to get ready for their intended use or sale, are

added to the cost of those assets, until such time when the assets are substantially ready for their intended

use or sale. All other borrowing costs are charged to statement of profit or loss in the period of as and when

incurred.

7.19 Taxation

Current

The charge for current taxation is based on taxable income at current rates of taxation after taking into

account tax credits, rebates and exemptions available, if any. However, for income covered under Final

Taxation Regime (FTR), taxation is based on the applicable tax rates under such Regime. The charge for

current tax also includes adjustments, where considered necessary, and provision for tax made in previous

years arising from assessments framed during the year for such years.

Deferred

Deferred tax is accounted for using the statement of financial position method in respect of temporary

differences arising from differences between the carrying amount of assets and liabilities in the consolidated

financial statements and the corresponding tax basis used in the computation of taxable income. Deferred

tax is calculated by using the tax rates enacted at the reporting date. In this regard, the effect on deferred

taxation of the portion of income subjected to Final Tax Regime is adjusted in accordance with the

requirements of Accounting Technical Release – 27 of the Institute of Chartered Accountants of Pakistan, if

considered material.

230