Page 139 - Interloop Annual Report 2018-2019

P. 139

NOTES TO THE UNCONSOLIDATED NOTES TO THE UNCONSOLIDATED

FINANCIAL STATEMENTS FINANCIAL STATEMENTS

FOR THE YEAR ENDED JUNE 30, 2019 FOR THE YEAR ENDED JUNE 30, 2019

21.1 Movement in issued, subscribed and paid up capital Before listing of the Company fair value of the options was determined based on the break up value of shares and exercise price at the date of each

grant of options. Exercise price was determined based on latest available audited financial statements of the Company. After listing of the Company

the exercise price shall be the weighted average of the closing market price of shares of the Company for the last 30 days prior to the date of grant

Ordinary Shares of Rs. 10 each fully Ordinary Shares of Rs. 10 each fully paid of options.

paid in cash bonus shares

Due to issuance of bonus shares of 300% of the existing paid up capital of the Company in current year and demerger of the investment segment

Note Voting Non-Voting Voting Non-Voting of the Company into Interloop Holdings (Pvt) Limited in last year, the break up value of the shares had been reduced to Rs. 11.91 per share. This

Number of shares in ‘000 necessitated the repricing of the existing options outstanding during the year. Moreover, the existing exercise price of Rs. 76.04 per share was also

not attractive at the moment due to the floor price of Rs. 45 per share set in the draft prospectus for the proposed IPO duly approved by the Securities

and Exchange Commission of Pakistan (SECP) and the Pakistan Stock Exchange (PSX) till date. Accordingly it was proposed to offer exercise price

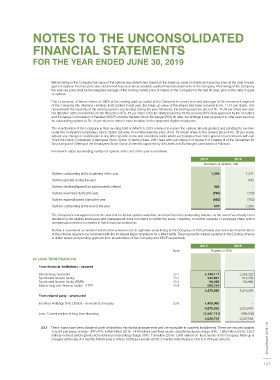

Opening balance 21,400 510 168,200 -

for outstanding options at Rs. 35 per share to make it more lucrative for the proposed eligible employees.

Issued during the year 21.1.1 109,500 756 570,300 1,531 The shareholders of the Company in their meeting held on March 5, 2019 resolved to reprice the options already granted and pending for exercise

under the Company's Employees Stock Option Scheme, from initial exercise price of Rs. 76.04 per share to the revised price of Rs. 35 per share,

Closing balance 130,900 1,266 738,500 1,531 without any change or modification in any other specific terms and conditions under which such options have been granted in accordance with rule

7(ii)of the Public Companies (Employees Stock Option Scheme) Rules, 2001 read with sub clause 3 of clause 6 of Chapter III of the Guidelines for

21.1.1 During the year the Company has issued 109 million ordinary shares of Rs. 10 each in Initial Public Offerings (IPO). (Note. 1.2) Structuring and Offering of the Employees Stock Option Schemes approved by Securities and Exchange Commission of Pakistan.

Information about outstanding number of options at the end of the year is as follows:

2019 2018

Note Rupees in ‘000 2019 2018

Numbers of options ‘000

22. RESERVES

Capital reserve Options outstanding at the beginning of the year 1,399 1,341

Options granted during the year - 933

Share premium 22.1 3,791,602 30,255

Options declined/lapsed but subsequently offered 426 -

Revenue reserve

Options exercised during the year (790) (172)

Employee share option compensation reserve 22.2 - 8,608 Options expired/lapsed during the year (465) (703)

3,791,602 38,863

Options outstanding at the end of the year 570 1,399

22.1 This represents premium received over and above face value of the shares issued to institutional investors, high net worth individuals and general The Company's management is of the view that no further options would be exercised from the outstanding balance as the same has already been

public through initial public offering (IPO) and employees of the Company through employees stock option scheme (ESOS). This reserve can be declined by the eligible employees and management does not intend to reoffer the same. Therefore, no further expense or employee share option

utilized by the Company only for the purposes specified in section 81 of the Companies Act, 2017. compensation reserve is created in these financial statements.

22.2 EMPLOYEES SHARE OPTION SCHEME (ESOS) Further, it is pertinent to mention here that the scheme is not in operation since listing of the Company on PSX primarily due to the fact that the terms

of the scheme require to be consistent with the increased legal compliance for a listed entity. The proposal for subject updation in the Existing scheme

is under review and pending approval from shareholders of the Company and SECP respectively.

The shareholders of the Company has approved Interloop Limited - Employee Stock Options Scheme, 2016 (“the scheme”) for grant of options to

certain eligible employees to purchase ordinary shares (non-voting) of the Company, to be determined by the Compensation Committee constituted

by the Board of directors of the Company. 2019 2018

Note Rupees in ‘000

Under the Scheme, the Company may grant options to eligible employees selected by the Compensation Committee, from time to time, which shall

not at any time exceed 15% of the paid up capital (ordinary and voting) of the Company (as increased from time to time). The option entitles an 23. LONG TERM FINANCING

employee to purchase shares at an exercise price determined in accordance with the mechanism defined in the scheme at the date of grant. The

aggregate number of shares for all options to be granted under the scheme to any single eligible employee shall not, at any time, exceed 3% of the From financial institutions - secured

paid up capital (ordinary and voting) of the Company (as increased from time to time). Further the grant of options in any one calendar year exceeding

3% of the paid up capital (ordinary and voting) shall require approval of the shareholders. However, once the number of shares issued under this Diminishing musharika 23.1 2,140,117 2,263,222

scheme equal fifteen percent (15%) of the paid up capital (ordinary and voting) of the Company, the entitlement pool shall be exhausted and this Syndicated finance facility 23.2 542,857 814,286

Scheme shall cease to operate, notwithstanding any subsequent increase in the paid up capital. Syndicated finance facility (BMR) 23.3 96,208 138,968

Islamic long term finance facility - ILTFF 23.4 696,754 -

The options will have a vesting period of one year and an exercise period of one year from the date options are vested as laid down in the scheme. 3,475,936 3,216,476

Option price shall be payable by the employee on the exercise of options in full or part. The options will lapse after completion of one year from the

date options are vested if not exercised. From related party - unsecured

Interloop Holdings (Pvt) Limited - associated company 23.5 1,400,000 -

Shares issued in response to exercise of options shall be Non-Voting Ordinary Shares, hereinafter called "Class B Shares" and shall not;

4,875,936 3,216,476

(i) have voting rights or right to receive notice, attend and vote at the general meeting of the Company, except and otherwise provided by the Less: Current portion of long term financing (1,247,191) (968,540)

Companies Act, 2017; and

3,628,745 2,247,936

(ii) be entitled for right shares (Ordinary and Voting).

23.1 These loans have been obtained under diminishing musharika arrangements and are repayable in quarterly installments. These are secured against 2018 - 19

Shares issues under this scheme will convert into ordinary shares after 3 years from the date of listing of the Company or after completion of 3 years

1st joint pari passu charge - JPP of Rs. 6,468 million (2018: 1,474 million) over fixed assets, specific/exclusive charge of Rs. 1,992 million (2018: 3,015

Interloop Limited from the date of issue, whichever is later. The Company will not be obliged to buy back the shares. However, if the employees wishes to sell the million) on fixed assets (plant and machinery) and ranking charge of Rs. 718 million (2018: 1,978 million) on fixed assets of the Company. Mark up is Annual Report

shares, the Company may buy back the shares at the lesser of the prevailing price on the securities exchange or at the break up value of the shares

charged at the rate of 3 months KIBOR plus 0.10% to 0.50% per annum (2018: 3 months KIBOR plus 0.10% to 0.75% per annum).

determined as per the latest audited financial statements of the Company.

136 137