Page 195 - InterloopAnnualReport2020

P. 195

NOTES TO THE UNCONSOLIDATED

FINANCIAL STATEMENTS

For the year ended June 30, 2020

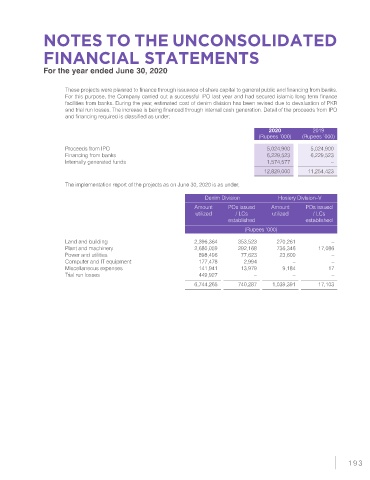

These projects were planned to finance through issuance of share capital to general public and financing from banks.

For this purpose, the Company carried out a successful IPO last year and had secured islamic long term finance

facilities from banks. During the year, estimated cost of denim division has been revised due to devaluation of PKR

and trial run losses. The increase is being financed through internal cash generation. Detail of the proceeds from IPO

and financing required is classified as under;

2020 2019

(Rupees ‘000) (Rupees ‘000)

Proceeds from IPO 5,024,900 5,024,900

Financing from banks 6,229,523 6,229,523

Internally generated funds 1,574,577 –

12,829,000 11,254,423

The implementation report of the projects as on June 30, 2020 is as under;

Denim Division Hosiery Division–V

Amount POs issued Amount POs issued

utilized / LCs utilized / LCs

established established

(Rupees ‘000)

Land and building 2,396,364 353,523 270,261 –

Plant and machinery 2,680,059 292,168 736,346 17,086

Power and utilities 898,496 77,623 23,600 –

Computer and IT equipment 177,478 2,994 – –

Miscellaneous expenses 141,941 13,979 9,184 17

Trial run losses 449,927 – – –

6,744,265 740,287 1,039,391 17,103

193