Page 127 - Interloop Annual Report 2018-2019

P. 127

NOTES TO THE UNCONSOLIDATED NOTES TO THE UNCONSOLIDATED

FINANCIAL STATEMENTS FINANCIAL STATEMENTS

FOR THE YEAR ENDED JUNE 30, 2019 FOR THE YEAR ENDED JUNE 30, 2019

Accordingly, the adoption of IFRS 9 has not had a significant effect on the Company’s accounting policies related b) Rendering of services

to financial assets and liabilities.

Revenue from a contract to provide services is recognized over time as the services are rendered.

6.2 IFRS 15, ‘Revenue from Contracts with Customers’:

c) Interest income

The Company has adopted IFRS 15 by applying the modified retrospective approach according to which the

Company is not required to restate the prior year results. Interest income is recognized as interest accrues using the effective interest method. This is a method

of calculating the amortized cost of a financial asset and allocating the interest income over the relevant

Key changes in accounting policies resulting from application of IFRS 15 period using the effective interest rate, which is the rate that exactly discounts estimated future cash receipts

through the expected life of the financial asset to the net carrying amount of the financial asset.

6.2.1 Revenue recognition

d) Other revenue

Revenue is recognized at an amount that reflects the consideration to which the Company is expected to be

entitled in exchange for transferring goods or services to a customer. For each contract with a customer, the Other revenue is recognized when it is received or when the right to receive payment is established.

Company: identifies the contract with a customer; identifies the performance obligations in the contract; determines

the transaction price which takes into account estimates of variable consideration and the time value of money; 6.2.2 Trade and other receivables

allocates the transaction price to the separate performance obligations on the basis of the relative stand-alone

selling price of each distinct good or service to be delivered; and recognizes revenue when or as each performance Trade receivables are initially recognized at fair value and subsequently measured at amortized cost using the

obligation is satisfied in a manner that depicts the transfer to the customer of the goods or services promised. effective interest method, less any allowance for expected credit losses.

Variable consideration within the transaction price, if any, reflects concessions provided to the customer such as The Company has applied the simplified approach to measuring expected credit losses, which uses a lifetime

discounts, rebates and refunds, any potential bonuses receivable from the customer and any other contingent expected loss allowance. To measure the expected credit losses, trade receivables have been grouped based on

events. Such estimates are determined using either the ‘expected value’ or ‘most likely amount’ method. The days overdue.

measurement of variable consideration is subject to a constraining principle whereby revenue will only be

recognized to the extent that it is highly probable that a significant reversal in the amount of cumulative revenue Other receivables are recognized at amortized cost, less any allowance for expected credit losses.

recognized will not occur. The measurement constraint continues until the uncertainty associated with the variable

consideration is subsequently resolved. Amounts received that are subject to the constraining principle are initially 6.2.3 Impacts of adoption of IFRS 15 on these unconsolidated financial statements

recognized as deferred revenue in the form of a separate refund liability.

The Company has concluded that revenue from sale of goods should be recognized at the point in time when

a) Sale of goods control of the asset is transferred to the customer, generally on delivery of the goods. Therefore, the adoption of

Revenue from the sale of goods is recognized at the point in time when the customer obtains control of the IFRS 15 did not have an impact on the timing of revenue recognition and the amount of revenue recognized.

goods, which is generally at the time of delivery. Otherwise, control is transferred over time and revenue is

recognized over time by reference to the progress towards complete satisfaction of the relevant performance The Company provides sales discounts to certain customers which is not in the nature of volume rebates

obligation if one of the following criteria is met: (discounts). The Company estimates provision for discounts and revenue is reduced by the amount of provision.

This is also in alignment with the requirements of IFRS 15 and did not have an impact on the revenue of the

- the customer simultaneously receives and consumes the benefits provided by the Company’s performance Company. Therefore, the application of the constraint on variable consideration did not have any further impact on

as the Company performs; the revenue recognized by the Company.

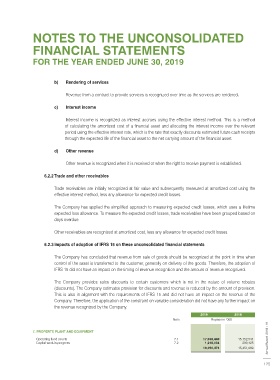

- the Company’s performance creates and enhances an asset that the customer controls as the Company 2019 2018

performs; or Note Rupees in ‘000

- the Company’s performance does not create an asset with an alternative use to the Company and the 7. PROPERTY, PLANT AND EQUIPMENT 2018 - 19

Company has an enforceable right to payment for performance completed to date.

Interloop Limited Operating fixed assets 7.1 17,038,440 15,152,544 Annual Report

7.2

1,218,034

Capital work-in-progress

299,425

15,451,969

18,256,474

124 125