Page 213 - InterloopAnnualReport2020

P. 213

INDEPENDENT AUDITOR’S REPORT

TO THE MEMBERS OF INTERLOOP

LIMITED

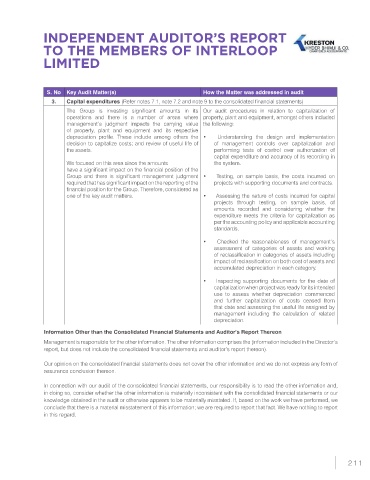

S. No Key Audit Matter(s) How the Matter was addressed in audit

3. Capital expenditures (Refer notes 7.1, note 7.2 and note 9 to the consolidated financial statements)

The Group is investing significant amounts in its Our audit procedures in relation to capitalization of

operations and there is a number of areas where property, plant and equipment, amongst others included

management’s judgment impacts the carrying value the following:

of property, plant and equipment and its respective

depreciation profile. These include among others the • Understanding the design and implementation

decision to capitalize costs; and review of useful life of of management controls over capitalization and

the assets. performing tests of control over authorization of

capital expenditure and accuracy of its recording in

We focused on this area since the amounts the system.

have a significant impact on the financial position of the

Group and there is significant management judgment • Testing, on sample basis, the costs incurred on

required that has significant impact on the reporting of the projects with supporting documents and contracts.

financial position for the Group. Therefore, considered as

one of the key audit matters. • Assessing the nature of costs incurred for capital

projects through testing, on sample basis, of

amounts recorded and considering whether the

expenditure meets the criteria for capitalization as

per the accounting policy and applicable accounting

standards.

• Checked the reasonableness of management’s

assessment of categories of assets and working

of reclassification in categories of assets including

impact of reclassification on both cost of assets and

accumulated depreciation in each category.

• Inspecting supporting documents for the date of

capitalization when project was ready for its intended

use to assess whether depreciation commenced

and further capitalization of costs ceased from

that date and assessing the useful life assigned by

management including the calculation of related

depreciation.

Information Other than the Consolidated Financial Statements and Auditor’s Report Thereon

Management is responsible for the other information. The other information comprises the (information included in the Director’s

report, but does not include the consolidated financial statements and auditor’s report thereon).

Our opinion on the consolidated financial statements does not cover the other information and we do not express any form of

assurance conclusion thereon.

In connection with our audit of the consolidated financial statements, our responsibility is to read the other information and,

in doing so, consider whether the other information is materially inconsistent with the consolidated financial statements or our

knowledge obtained in the audit or otherwise appears to be materially misstated. If, based on the work we have performed, we

conclude that there is a material misstatement of this information; we are required to report that fact. We have nothing to report

in this regard.

211