Page 212 - InterloopAnnualReport2020

P. 212

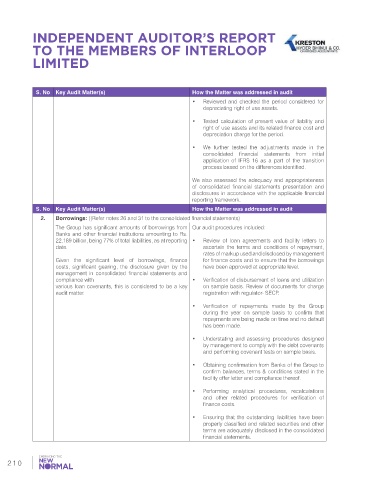

INDEPENDENT AUDITOR’S REPORT

TO THE MEMBERS OF INTERLOOP

LIMITED

S. No Key Audit Matter(s) How the Matter was addressed in audit

• Reviewed and checked the period considered for

depreciating right of use assets.

• Tested calculation of present value of liability and

right of use assets and its related finance cost and

depreciation charge for the period.

• We further tested the adjustments made in the

consolidated financial statements from initial

application of IFRS 16 as a part of the transition

process based on the differences identified.

We also assessed the adequacy and appropriateness

of consolidated financial statements presentation and

disclosures in accordance with the applicable financial

reporting framework.

S. No Key Audit Matter(s) How the Matter was addressed in audit

2. Borrowings: ((Refer notes 26 and 31 to the consolidated financial statements)

The Group has significant amounts of borrowings from Our audit procedures included:

Banks and other financial institutions amounting to Rs.

22.189 billion, being 77% of total liabilities, as at reporting • Review of loan agreements and facility letters to

date. ascertain the terms and conditions of repayment,

rates of markup used and disclosed by management

Given the significant level of borrowings, finance for finance costs and to ensure that the borrowings

costs, significant gearing, the disclosure given by the have been approved at appropriate level.

management in consolidated financial statements and

compliance with • Verification of disbursement of loans and utilization

various loan covenants, this is considered to be a key on sample basis. Review of documents for charge

audit matter. registration with regulator- SECP.

• Verification of repayments made by the Group

during the year on sample basis to confirm that

repayments are being made on time and no default

has been made.

• Understating and assessing procedures designed

by management to comply with the debt covenants

and performing covenant tests on sample basis.

• Obtaining confirmation from Banks of the Group to

confirm balances, terms & conditions stated in the

facility offer letter and compliance thereof.

• Performing analytical procedures, recalculations

and other related procedures for verification of

finance costs.

• Ensuring that the outstanding liabilities have been

properly classified and related securities and other

terms are adequately disclosed in the consolidated

financial statements.

210