Page 202 - InterloopAnnualReport2020

P. 202

NOTES TO THE UNCONSOLIDATED

FINANCIAL STATEMENTS

For the year ended June 30, 2020

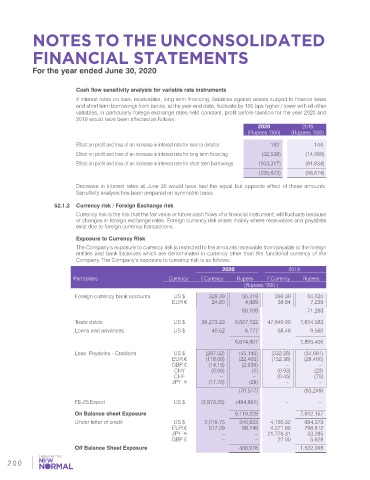

Cash flow sensitivity analysis for variable rate instruments

If interest rates on loan, receivables, long term financing, liabilities against assets subject to finance lease

and short term borrowings from banks, at the year end date, fluctuate by 100 bps higher / lower with all other

variables, in particularly foreign exchange rates held constant, profit before taxation for the year 2020 and

2019 would have been affected as follows:

2020 2019

(Rupees ‘000) (Rupees ‘000)

Effect on profit and loss of an increase in interest rate for loan to director 182 144

Effect on profit and loss of an increase in interest rate for long term financing (32,538) (14,696)

Effect on profit and loss of an increase in interest rate for short term borrowings (103,317) (81,834)

(135,673) (96,674)

Decrease in interest rates at June 30 would have had the equal but opposite effect of these amounts.

Sensitivity analysis has been prepared on symmetric basis.

52.1.2 Currency risk / Foreign Exchange risk

Currency risk is the risk that the fair value or future cash flows of a financial instrument, will fluctuate because

of changes in foreign exchange rates. Foreign currency risk arises mainly where receivables and payables

exist due to foreign currency transactions.

Exposure to Currency Risk

The Company’s exposure to currency risk is restricted to the amounts receivable from/payable to the foreign

entities and bank balances which are denominated in currency other than the functional currency of the

Company. The Company’s exposure to currency risk is as follows:

2020 2019

Particulars Currency F.Currency Rupees F.Currency Rupees

(Rupees ‘000 )

Foreign currency bank accounts US $ 329.39 55,419 390.39 64,024

EUR € 24.80 4,689 38.84 7,239

60,108 71,263

Trade debts US $ 39,273.23 6,607,722 47,649.90 7,814,583

Loans and advances US $ 40.52 6,777 58.48 9,560

6,674,607 7,895,406

Less: Payables - Creditors US $ (267.52) (45,145) (332.28) (54,661)

EUR € (118.09) (22,405) (152.36) (28,490)

GBP £ (14.15) (2,939) – –

CNY (0.06) (1) (0.93) (23)

CHF – – (0.45) (75)

JPY ¥ (17.70) (28) – –

(70,517) (83,249)

FE-25 Export US $ (2,873.25) (484,861) – –

On Balance sheet Exposure 6,119,228 7,812,157

Under letter of credit US $ 2,019.75 340,833 4,160.32 684,373

EUR € 517.29 98,146 4,271.95 798,812

JPY ¥ – – 21,776.31 33,285

GBP £ – – 27.00 5,628

Off Balance Sheet Exposure 438,978 1,522,098

200